Today’s adults, the pensioners of tomorrow, are in line for a bad shock if they don’t pay more attention to their current pension plans, experts have warned.

People who do not adequately review their pension schemes may find that they will have to continue work long after retirement simply to make ends meet, as the default pension option in many cases is not the right one.

Baring Asset Management looked into people’s attitudes towards their pension plans and found interesting results. Only 52 percent of the people quizzed said that they had actually examined their pension schemes and attempted to asses them, out of this percentage two fifths admitted that they simply opted for the default option available when they were offered their plan. Shockingly, 19 percent said they were unsure as to how their money was invested and that a clear explanation was not given. Perhaps even more shockingly a further 33 percent claimed that they didn’t know what option they had chosen.

“The fact that individuals seem to continue to take little or no interest in financially planning for their retirement is of real concern. The industry needs to improve the way in which pension advice is given so that people better understand the levels of risk and return that they can expect from their portfolios,” said Marino Valensise, of Barings Asset Management.

Worryingly the survey also discovered that around 12.6 million UK citizens had never paid a second thought to pensions, and that they had not considered how they were going to support themselves come retirement.

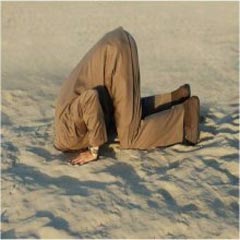

Tom McPhail a pension’s specialist told The Telegraph that people who have a ‘head in the sand’ mentality could suffer unfortunate consequences: “They will arrive in their sixties with inadequate savings to allow them to retire. Because they haven't been saving enough or haven't been keeping track of where their money is invested, they will have to carry on working.”

Retirement planning can be time consuming, luckily help is at hand. If you need assistance finding the right pension, or want to discuss your retirement plans with a qualified specialist speak to a recommended financial planner.