In light of the British governments higher rate tax increase many high earners have pledged to leave the country before the new tax year. Of course many celebrities have already moved offshore in order to avoid tax.

Find out how to legally convert your expat status to tax exile status and save thousands by contacting a specialist IFA now.

This is our Top Ten list of celebrity tax exiles:

10) Phil Collins

Extremely successful, and the first of three entries from the world of music, Phil Collins claims to have only left Britain because Labour won the 1997 election. However some people have speculated that he has done so simply to take advantage of Switzerland's lower tax regime. True to his word however, he has stated that he will return if the Conservatives win the next election.

9) Tracy Emin

The only artist on our list, and the only woman, Tracy Emin gets an honourable mention even though she hasn’t left Britain yet. Tracy has said she is “very seriously considering leaving Britain...I’m simply not willing to pay tax at 50 percent”. This is her response to the Governments 50 percent top rate of tax coming into force in April 2010. It has been rumoured she wishes to go to France as she believes artists are treated with more regard than in the UK. Only time will tell if she ends up in France proper (40 percent top rate) or Monaco (no income tax).

8) David Bowie

The Glam Rock legend has never been far from controversy. The second musician on our list, he is lauded as a musical genius by many. David moved to Switzerland in 1976 to avoid the then 83 percent income tax for highest rate earners. It has been estimated that his personal wealth is over £500million.

7) Sir Sean Connery

Regarded by many as the best of the James Bond actors, Sir Sean’s lucrative film career and his politics have played a big part in his choice of residence. The first of two actors on the list, he left Britain in the seventies, moving first to Spain, then to the Bahamas in 1999. Whilst he undoubtedly saved millions in tax, he states it is a political move: “Like a lot of Scots abroad I look forward to coming home to an independent Scotland”.

6) Jenson Button

The current Formula 1 world champion, Jenson Button is a resident of Monaco where he takes advantage of zero income tax. He also has properties in the UK and Bahrain.

5) Lewis Hamilton

The youngest ever Formula 1 world champion in 2008, Lewis announced at the start of his record breaking season that he was following many British F1 drivers and moving to Switzerland. Although claims have been made that this was a privacy issue as well as a tax issue, he has since stated that although he is not happy living in Switzerland, he has no intention of returning home “for the moment”. It is thought that his career earnings could well exceed £1billion so he will continue to save tens of millions by remaining abroad.

4) Stelios Haji-Ioannou

The first of two businesspeople on the list, Stelios is the founder of Easyjet and has an estimated fortune of £1.29 billion. The popular entrepreneur stated “I have no UK income to be taxed in the UK”. Stelios has saved millions in income tax by residing in Monaco and registering his holding company, EasyGroup, in Jersey. He is a big believer in education and donates 20 scholarships per year for both undergraduate and postgraduate study at the London School of Economics and City University, London.

3) Sir Michael Caine

The top placed actor on our list, Sir Michael’s popularity has spanned generations, indeed many claim his best work have been in the recent Batman films and various independent roles including ‘Is Anybody There?’ and ‘Harry Brown’. In the 1970s, Sir Michael left Britain in protest at the 83 percent top rate of income tax, but did return when taxes were lowered. He stated recently that: “I decided not to become a tax exile, so I stayed in Britain, but they kept putting the tax up, so I’d do any old thing every now and then to pay the tax, that was my tax exile money. I realised that’s not a socialist country, it’s a communist country without a dictator, so I left and I was never going to come back” He has also expressed dismay at the 50 percent top rate of tax.

2) Sir Philip Green

One of Britain’s most powerful and successful businessmen, Sir Philip deserves his place as the top placed businessman for both his immense wealth and the tenacity in which he has avoided tax. In a highly interesting manoeuvre, Sir Philip manages his various businesses through a holding company - Taveta Investments. This is registered in the name of his wife Christina, a South African who resides in Monaco. The family and company thus manage to avoid tens of millions in tax. Although commonly criticised for his tax avoidance techniques, Sir Philip is also widely renowned for his philanthropy, pumping more than £6million into education and making various charity donations.

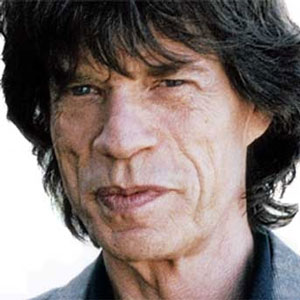

1) Sir Mick Jagger

Sir Mick tops our list due to his fame and constant media presence. As front man to the most successful rock and roll band of all time, his popularity spans five decades and three generations. The energetic singer has fathered seven children by four different women and has been linked to a host of female celebrities and models. He continues to strut around the stage for hours on end despite being 66 years old.

Although not the richest person on our list, he was the first to become a tax exile. In 1972, The Rolling Stones left Britain and moved to the south of France for tax purposes. The title of the bands seminal album ‘Exile on Main St.’ is a reference to this move.