A Self-Invested Personal Pension (SIPP) is a government approved personal pension plan. This is distinctly different from any private pension, be it a work based pension scheme or a privately owned personal pension plan. SIPPs allow for a greater range of investments than personal pension plans, however for expats the benefits of QROPS generally outweigh those of SIPPs.

Please note, you can only utilise a QROPS if you are between the ages of 18 to 75; and are a non-resident British citizen, or intend to be within the next 12 months, or if you are not a UK citizen and are planning to leave the UK within one year.

The basis of a SIPP is to allow individuals to invest their pension as they see fit; in practice however, many SIPP products are actually managed fully by the provider. The other main option favoured by providers is a hybrid scheme where some of the assets are held in a conventional insured fund, and the rest is self-invested by the policy holder. This is to ensure the providers costs are covered. The final option is a full access scheme where the holder is able to invest where he or she wishes, as long as it is within HMRCs allowable investment asset class.

All SIPPs come with the normal HMRC restrictions on pension plans; you cannot draw down until you are 55, there is a lifetime allowance threshold of £1.8million and potential tax liabilities if you go above this and on income from annuities.

QROPS can offer all of the investment benefits described above; but with a lower tax threshold, no lifetime allowance threshold and little or no tax on capital gains or income.

Upon maturity, a SIPP offers a one off 25% lump sum payment that is tax free. QROPS offers up to 30% tax free. Once you reach 75 in the UK, you must either purchase an annuity or set up an ASP. Keep in mind a £50,000 annuity will only pay around £75 per week in income. There is no such restriction on QROPS; you are free to do as you wish. If your pension income exceeds certain limits then UK residents can become liable for income tax. Non-residents face no such tax cost, but have the benefit of being able to draw down their money as they wish (including the option of a weekly income).

Inheritance issues play a large role in pension plans. UK schemes of all descriptions do not class pensions as an asset. As you will have been forced to purchase an annuity, you cannot pass on the benefits to your heirs. Whilst some annuities do allow a limited amount of income to be passed on, expect the majority of your money to go to the annuity provider and HMRC.

QROPS are an asset and can be passed on as such (subject to the inheritance tax laws where you are resident). They can be easily wrapped up in Trust to pass on to your heirs in a tax efficient and expedient manner.

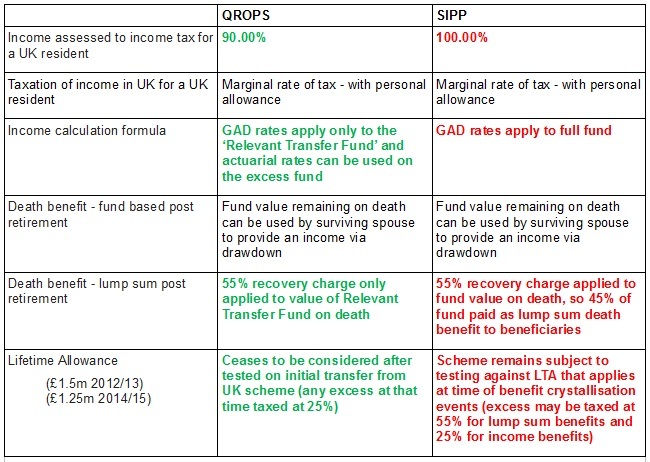

The quick check table below lays out the key differences between QROPS and SIPP:

Keep in mind these are complex decisions that do require planning and professional help. A QROPS is not for everyone; some may find it better to purchase a SIPPS even though they are not a UK resident. Speak to a specialist financial adviser for genuine impartial information on planning your retirement.