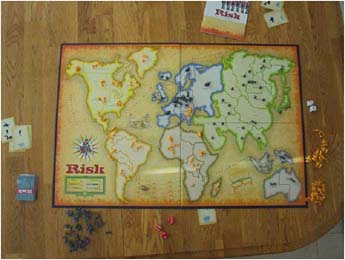

Many of you will be familiar with the board game Risk. The game is on a world map split into territories, you conquer territory by pitching army against army. All of this, and it still comes down to the roll of dice. Or does it?

Whilst I don’t wish to bore most of you silly with talk of advanced board game strategy there are a few parallels between the game and the economic theory of risk. You attack and defend using dice, where the defender has the advantage; if both dice are the same, the defender wins and an attacking army is removed. You get bonus armies for holding continents at the start of your turn.

Australasia with only one front is the easiest continent to defend. As a trade off, the prize for retaining it (two armies) is small. The same applies for low risk investments; for example a simple deposit account pays very little interest but your cash is essentially risk free.

South America has two fronts to defend, but you gain three armies if this is achieved. In the same respect, Equity or Mutual Funds offers a low risk with modest growth.

Things get slightly trickier with the North American continent. You risk being attacked from any of three borders but the five armies you receive for retaining the continent may, in your opinion, outweigh the risk of being attacked. In the same way, investing in the stock market opens you to a medium investment risk but the rewards can be large.

Now take a look at Asia, it has a whopping five borders to protect but gains a massive seven armies if you can take it all. A good financial illustration is that of Junk Bonds, or Derivatives, both of which carry a high risk factor but can produce spectacular returns.

Of course, keep in mind that your risk to reward in the board game comes from winning the game or not; and as serious as that is for all but the newest Risk players, it is not the same as putting your own hard earned cash on the line.

To learn more about risk, and how it might affect your investment decisions please see our Risk and Diversification and Risk and Pension Optimisation articles.